If you don’t comply, you can be fined up to £5,000 each day, more if you have over 500 employees. You may believe that the government pension scheme, NEST, will take care of the extra administration for you, but it won’t.

Fortunately, MAP Enrolment Solutions can help you through this maze by providing a panel of providers. A solution that means you can stay focused on building your business – not running your pension scheme. A solution that’s right for you and right for your workforce. A solution that will provide peace of mind for you and a great deal for your employees.

MAP Enrolment Solutions provides a more comprehensive solution to the challenges you face than any other proposition. That leaves you to focus on running your business.

Contact us today and arrange a no obligation consultation to find out more about how Auto Enrolment affects you.

Administration

We'll categorise your employees, send the right communications to the right people (and at the right time), assist with changes to your payroll systems and make sure your records are accurate and up to date at all times.

Support and training.

We'll provide dedicated telephone support to make sure everything works smoothly and provide training for your staff.

Investment Committee.

In-house investment professionals will choose the right funds for you and your employees and regularly review performance and investment strategy.

Telephone support.

A specialist helpline will be available to answer any questions your employees may have about the pension scheme or Auto Enrolment – and we'll even offer this service to employees who opt out!

Online support.

We'll set up a dedicated secure website providing your employees with online assistance at all times.

Compliance.

As well as making sure you are complying with the regulations, our service includes completing your Declaration Of Compliance with The Pensions Regulator.

All of these features combine to create a unique end to end solution that allows you to focus on building your business, not managing your Workplace Pension.

Contact us today and arrange a no obligation consultation to find out more about how Auto Enrolment affects you.

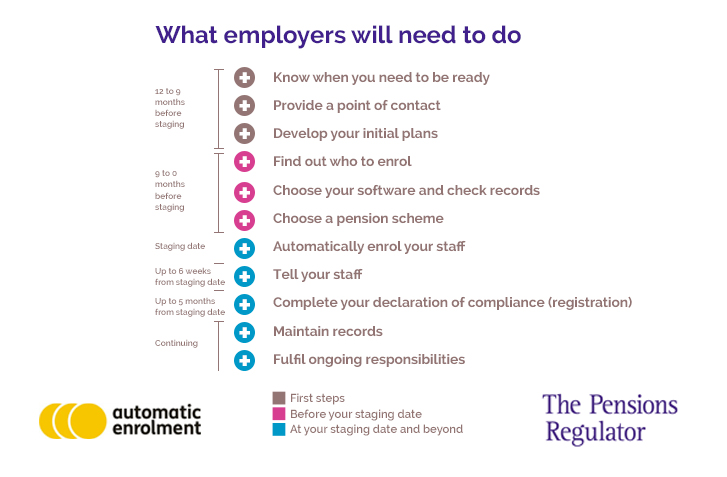

Below is a summary of the Auto Enrolment procedures and their time burdens on your team

| Auto Enrolment Procedure | Time Burden (working days) |

|---|---|

| Know your staging date and Auto Enrolment process | Up to 10 days; one-off |

| Nominate a point of contact | Up to 8 hours; one-off |

| Develop a pension plan | Up to 20 days; one-off |

| Construct the designated communications | Up to 5 days; one-off |

| Liaise with payroll provider | Up to 6 days; one-off |

| Put in place adequate business processes | Up to 30* days; one-off |

| Choosing a pension scheme for Auto Enrolment funds | Up to 9 days; one-off |

| Set-up pension scheme / liaise with pension provider | Up to 3 days; one-off and monthly |

| Classify workers into categories | Up to 5 days; one-off and monthly |

| Auto enrol eligible employees | Up to 4 days; one-off and monthly |

| Process opt outs, opt ins and joining requests and process automatic re-enrolment after three years | Up to 6 days; one-off and monthly |

| Addressing staff queries about Auto Enrolment | Up to 3 days; one-off and monthly |

| Register with The Pensions Regulator | Up to 5 hours; one-off |

| Keeping audit able records | Up to 10 hours; monthly |

| Keeping up with new Auto Enrolment rules and procedures | Up to 8 hours; monthly |

| Total one-off time burden | Up to 103 man days |

| Total monthly recurring time burden | Up to 3.5 man days |

*This could be up to 40 man days for the very largest business.

Source: Creative Auto Enrolment data, Cebr analysis.

Contact us today to enquire about an agency with MAP Enrolment solutions.

All companies with 30 or less employees are now nearing their Staging Date for implementing a Workplace Pension Scheme. Do you know your staging date?